As tax filing season quickly approaches, it’s important to know your options when filing your federal tax return. One of those options includes how you want to receive your tax return refund. You have two options when receiving your IRS tax return refund. You can either get it via check mailed to you or through direct deposit with your bank. The easiest, fastest and safest way to receive your refund is through direct deposit. 80% of tax payers choose direct deposit each year because of the simplicity of it. Direct deposit is free and it allows you to deposit your refund in up to 3 different bank accounts.

Cailey Taylor

Recent Posts

How to Avoid Waiting For Your 2017 Tax Return Refund

With tax season approaching quickly, it is important that you find the right IRS tax preparer to help file your tax returns. Regardless of who prepares the actual return, the taxpayer is liable for all the information submitted and any money owed after the return is filed. So, it’s important that you find someone who knows how to file individual tax returns. Quite often taxpayers get into trouble with the IRS because of a tax preparer that did not file correctly or made mistakes on their individual tax return. Here’s a few tips from the IRS that can help taxpayers find the best tax preparers.

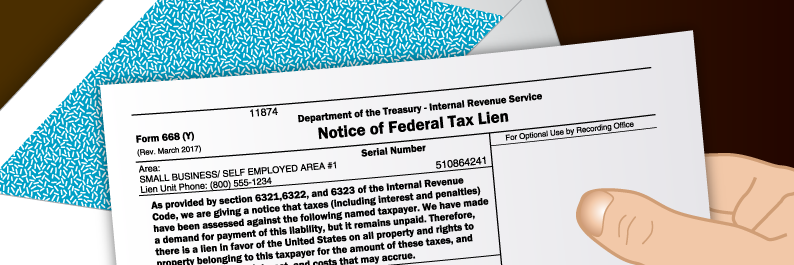

The IRS sends millions of letters to taxpayers every year for many different reasons. These letters can be letting you know anything from the money you owe the IRS, problems with your tax return, or if you are going to be levied. Some letters need a response, while others are just giving you an update. Any notification from the IRS can be scary and if you are getting them for the first time, you might not be sure what the letters mean. Here are a few important notices to be aware of as some may require urgent action.

Floyd Mayweather Jr. may be undefeated in the ring, but the boxing champion could lose a couple million dollars due to tax problems. The IRS currently has Mayweather on the hook for $7.2 million in taxes for 2010, and that is on top of the $22.2 million the undefeated boxer owes for 2015. Mayweather filed a petition back in July that argued that the boxer, who earned $200 million for his fight against Manny Pacquiao, doesn’t have the cash on hand to pay his debt for 2015. The IRS refused a direct request by the fighter to pay in installments until he is paid for the Conor McGregor fight. The agency says it intends to levy Mayweather. This latest episode comes after Mayweather paid $15.5 million for over 5 years of taxes. Mayweather paid the debt only after the IRS filed liens against him. While waiting on the petition to make it to tax court, the IRS could seek to withhold Mayweather’s winnings from the McGregor fight by arguing that he wouldn’t pay his taxes otherwise.

The Difference Between an IRS Tax Lien and an IRS Levy

You hear it all the time on the news about someone getting their bank account levied or someone getting a lien placed on their house. It seems scary and like most things with the IRS, the difference between a lien and a levy can be confusing to a taxpayer. Most taxpayers aren’t sure what an IRS wage levy is or how to know if you have a tax lien. We decided to break down the difference between a levy and lien and what you can expect from either action.

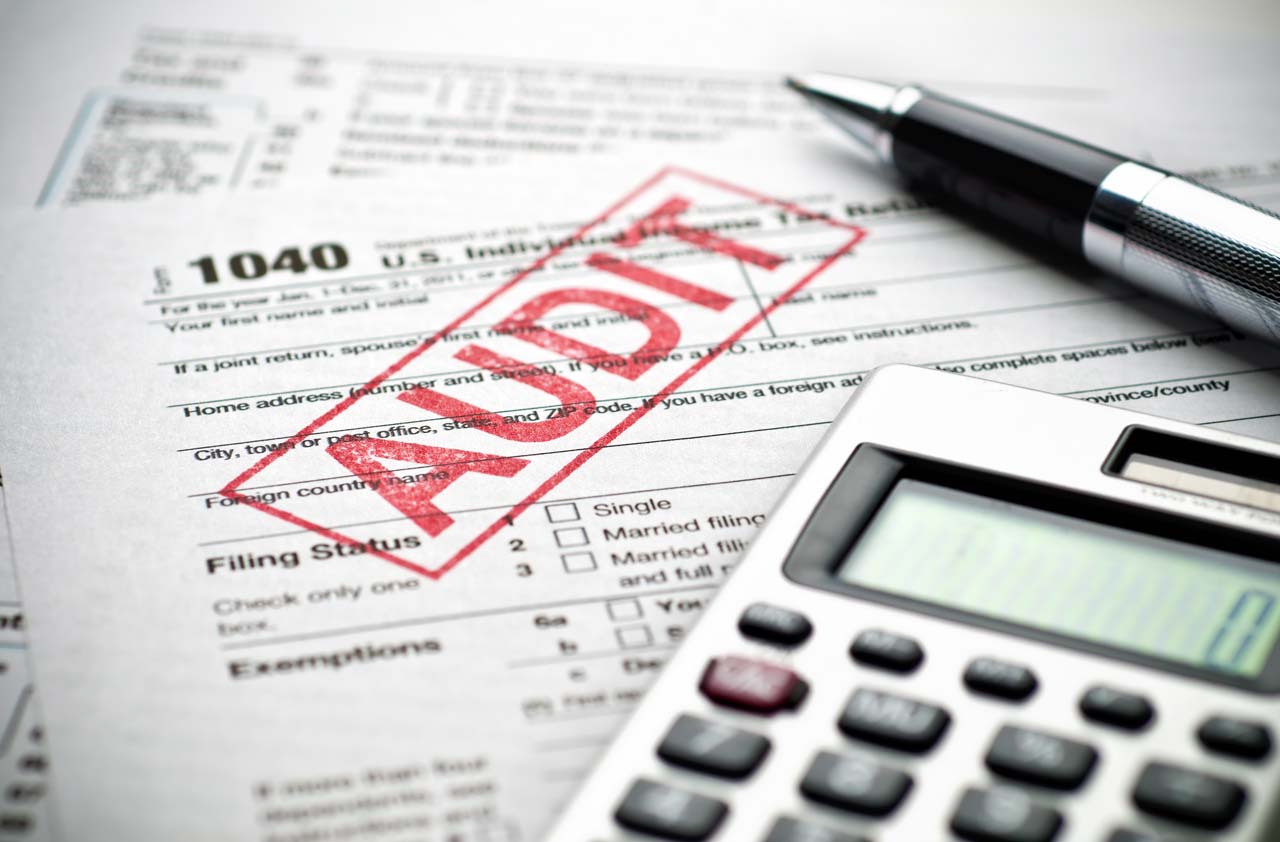

On this month’s closed case round up, we have one business investor who got audited after trying to claim loss income, a retired IRS employee that fell behind on her taxes, and a self-employed contract pumper that forgot to file a few years of his tax returns. Here’s the details on how some of our clients fell into tax trouble, and how we helped get them out!

If a Revenue Officer is assigned to your case to collect your past tax debt you should not act alone. Revenue Officers are authorized with absolute collection power. Normally we tell clients that the IRS will not call them. The exception to this rule? IRS Revenue Officers. Not only can they call you, they can show up on your doorstep! If it is your business that’s in tax trouble be prepared for the possibility that your customers will receive notices instructing them to send the IRS your money instead of sending it to you.

Audits can be scary and confusing to most taxpayers. Most don’t know how or what the IRS looks at to determine who to audit each year. Audits can be a long and exhaustive process that examines every aspect of your financial history for the tax year in question. The average taxpayer won’t be audited in their lifetime, but it could happen to you. To help you learn more about audits, we have your biggest questions about IRS audits and the answers for those very important questions.

Tags: Tax, audit help, Audit

How to Determine if You can Claim a Dependent on Your Tax Return

Tax season is upon us and as your life changes each year, so does the way you file taxes. One of the biggest changes can be when you have a child or when your parent moves in with you. Both of those changes can give you the opportunity to save money by claiming them as your dependent.

For every qualified dependent you claim, you can reduce your 2017 taxable income by $4,050. That can add up to a lot of money, but how do you know who qualifies as a dependent? Well, there are two types of dependents and each type is subject to different rules. For both types of dependents, the dependent must be a U.S. citizen or a resident of Canada or Mexico. You also can’t claim someone who takes a personal exemption for their self or claims another dependent on their own tax form. This also applies to someone who is married and files a joint tax return.

Tags: Tax Return, Tax, Tax Deductions

The IRS sends millions of letters to taxpayers every year for many different reasons. These letters can be letting you know anything from the money you owe the IRS, problems with your tax return, or if you are going to be levied. Some letters need a response, while others are just giving you an update. Any notification from the IRS can be scary and if you are getting them for the first time, you might not be sure what the letters mean. Here are a few important notices to be aware of as some may require urgent action.

.jpg)