The Tax Cuts and Jobs Act created hundreds of changes to the U.S. Tax code and changed how a lot of people and businesses will file their taxes this year. The good news is some of those changes are going to benefit farmers and ranchers and help their bottom line! The Tax Cuts and Jobs Act was passed in December 2017 and takes effect for the 2018 tax year. Farmers and ranchers will need to look at their current financial situation and reassess some of their deductions and credits to see if they can benefit more from the tax law changes.

Does Tax Reform Affect Bottom Line for Farmers and Ranchers?

Tags: Tax Return, Tax, Tax Deductions, tax extension, Tax Help, Tax Law, Tax Cuts and Jobs Act, Tax Court, Sales Tax

Check out just a few of the FANTASTIC results achieved for our clients last month! This months closed case round up features a contractor whose severe health problems led to a large tax debt, plus a client who tried to resolve their tax issues on their own and ended up coming back to us for help.

Tags: Tax Return, Tax, Tax Deductions, audit help, Audit, levy, tax extension, Tax Help, Tax Law, Tax Cuts and Jobs Act, CDP, Tax Scams, Liens, Tax Court, Sales Tax, Student Loans, Tax Levy, Tax Lien, IRS Tax Lien

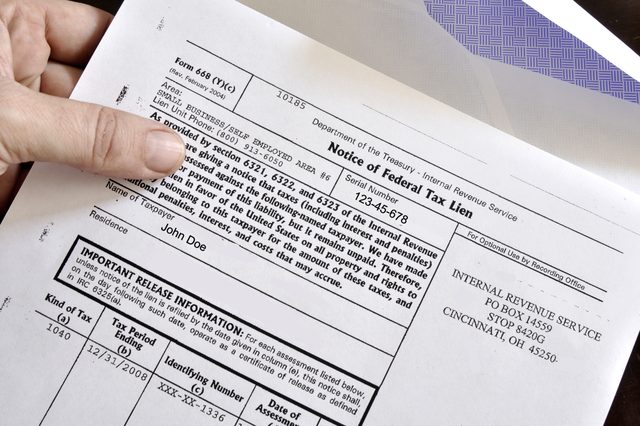

There is nothing scarier than going to your mailbox and seeing a notice of the IRS’s intent to levy you. Owing taxes can be scary enough, but when you add in the stress of being levied or having a lien placed on your property, it can be too much. If you have received notices from the IRS or you have been talking about possible problems with your taxes, you may have come across the terms Tax Levy and Tax Lien. The two are types of collection action used by the IRS to collect on an unpaid tax debt. They have some similarities and they both have stark differences you need to be aware of.

Tags: Tax Return, Tax, Tax Deductions, levy, tax extension, Tax Help, Tax Law, Tax Cuts and Jobs Act, CDP, Liens, Tax Court, Tax Levy, Tax Lien, IRS Tax Lien

Deadline for New Depreciation Deduction Fast Approaching

Time is running out for taxpayers looking to take a depreciation deduction on certain property they have used in 2017. Individuals and calendar-year corporations must generally file the election with the IRS by October 15th.

Tags: Tax Return, Tax Deductions, audit help, Audit, levy, tax extension, Tax Help, Tax Cuts and Jobs Act, CDP, Tax Scams, Tax Court

New Tax Credit Available to Businesses With Paid Leave

Do you provide paid family or medical leave to your employees? Have you thought about it? If you don’t, now would be a great time to start! The IRS has announced that eligible employers who provide family and medical leave may qualify for a new business tax credit for years 2018 and 2019!

Tags: Tax Return, Tax Deductions, Audit, Tax Help, Tax Law, Tax Cuts and Jobs Act, Tax Court

What Is the 20% Qualified Business Income Deduction?

The Tax Cuts and Jobs Act created hundreds of changes to the U.S. tax code and will affect every taxpayer in America. The changes range from eliminating or lowering exemptions and special tax credits to increasing the standard deduction. The new tax law also re-did the tax brackets and changed the tax rates for some people and businesses. One of the changes most people don’t know about is the 20% Qualified Business Income Deduction. This is a provision meant to benefit businesses with pass through income and is effective from 2018 until 2025.

Tags: Tax Return, Tax, Tax Deductions, tax extension, Tax Help, Tax Law, Tax Cuts and Jobs Act, Tax Court

Do you owe more in taxes this year than you anticipated? If you are unable to pay your balance in full by the tax deadline, it can be a very stressful and scary feeling. You wonder if the IRS will seize your bank account or your home. The good news is that there are options out there for you! The IRS has different payment plans and options for taxpayers depending on your income and your financial situation. The important thing is to be proactive and trying to find a payment arrangement with the IRS as soon as possible. The IRS can penalize you if you do not pay your taxes by issuing a failure to pay penalty.

Tags: Tax Return, Tax Deductions, audit help, Audit, levy, Tax Help, Tax Law, Tax Cuts and Jobs Act, CDP, Tax Scams, Tax Court

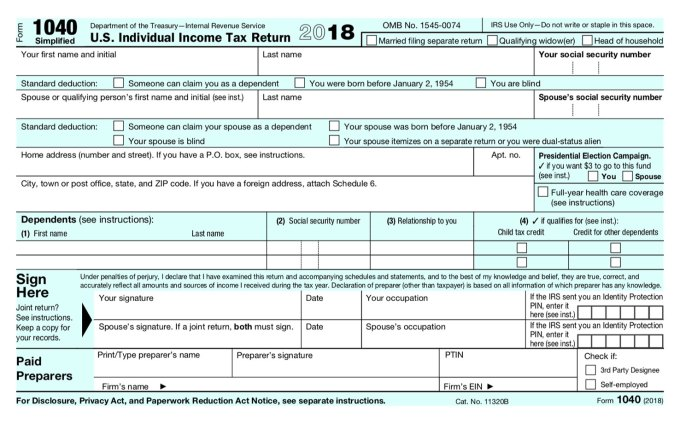

As the US continues to undergo major tax reform changes, there is one in particular that might catch your eye. The IRS released a draft of a new post-card sized Form 1040 that will streamline tax returns and allow all American taxpayers to use the same form. The updated form will replace and consolidate the 1040 with the 1040A and 1040EZ as well, eliminating the latter two. The IRS plans to complete the streamlined Form 1040 over the summer with the help of the tax professional community. The 1040 forms are the most common tax forms and this will be the first major change to the forms in decades.

Tags: tax extension, Tax Help, Tax Cuts and Jobs Act, Tax Court

It’s that time of the year when everyone seems to be tying the knot and probably the last thing on the mind of a newlywed is their taxes. If you plan on getting married this year, here are some tax tips to help you have a long prosperous marriage and hopefully avoid some tax trouble.

Tags: Tax Return, Tax, Tax Deductions, Tax Help, Tax Law, Identity Theft, Tax Court, Wedding

Most likely you have bought something online in the last year, a gift, furniture, clothes, or something small. The online retail market has grown exponentially in the last few years and is expected to pass the trillion-dollar mark by 2019. As a result, forty-five states and local governments are missing out on billions of tax dollars annually. The Supreme Court has sided in favor of states who are trying to collect sales tax from online retailers.

Tags: Tax Law, Tax Court, Sales Tax, Supreme Court